How Offshore Company Formations Provide Legal Protection and Flexibility

Wiki Article

Checking Out the Services Offered in Offshore Business Formations: What You Required to Know

Offshore company formations provide a variety of solutions made to help with business success while ensuring compliance with lawful demands. These services can consist of firm registration, lawful suggestions, and setups for privacy through nominee supervisors. Additionally, considerations around tax optimization and possession defense are critical. Understanding these elements can greatly affect one's decision-making process. Nonetheless, the complexities of guiding and selecting the best jurisdiction with guidelines increase even more inquiries. What should one take into consideration following?Understanding Offshore Business Frameworks

What defines an offshore company framework? An offshore firm is typically registered in an international jurisdiction, frequently characterized by beneficial regulatory environments and confidentiality. These structures are created to provide lawful splitting up between the business's possessions and its owners, enabling a variety of economic and functional advantages. Offshore companies can be established as different kinds, consisting of restricted responsibility business (LLCs), firms, or depends on, depending on the regulatory structure of the chosen jurisdiction.Secret functions of these structures include boosted privacy, property protection, and simplicity of global service transactions. Additionally, they commonly call for minimal regional presence and can facilitate the administration of investments across borders. The option of a particular overseas territory can substantially influence the functional abilities and compliance needs of the business. Overall, understanding the complexities of overseas business frameworks is essential for investors and entrepreneurs seeking to enhance their business approaches.

Tax Benefits of Offshore Firms

Offshore business supply considerable tax advantages that can improve earnings and monetary efficiency for local business owner. Among the main benefits is the possibility for minimized corporate tax rates, which can be notably less than those in the owner's home nation. Several overseas territories supply tax motivations, such as tax holidays or exemptions on particular types of revenue. In addition, offshore companies may gain from beneficial tax obligation treaties, enabling for the decrease or elimination of withholding tax obligations on returns, nobilities, and interest. This can cause increased capital and far better reinvestment opportunities. Some offshore entities can operate under a territorial tax obligation system, which only taxes income created within that territory. This framework can be particularly advantageous for organizations involved in worldwide profession or on the internet solutions, enabling them to enhance their tax responsibilities while preserving compliance with global regulations. In general, these tax benefits can significantly add to lasting economic success.Personal Privacy and Discretion Features

Exactly how can service proprietors secure their delicate info while gaining from global opportunities? Offshore business formations provide robust privacy and discretion attributes that appeal to entrepreneurs looking for discernment (Offshore Company Formations). Many territories provide nominee solutions, permitting people to select 3rd parties as directors or investors, thereby hiding their identifications from public documentsFurthermore, strict data security laws in countless offshore areas ensure that delicate information remains confidential. Offshore companies usually gain from improved financial privacy, with regulations that secure client identifications and economic deals.

The usage of exclusive addresses for registered offices lessens exposure to public analysis.

These privacy measures enable company owner to operate with greater self-confidence, knowing their sensitive data is protected. By leveraging these features, business owners can focus on strategic development chances without the constant problem of info direct exposure.

Possession Protection Techniques

While guiding with the intricacies of international business, entrepreneurs have to prioritize possession defense to protect their riches from possible threats. Offshore company formations offer durable approaches for mitigating exposure to legal insurance claims, lender actions, and political instability. One efficient technique involves establishing a restricted responsibility firm (LLC), which separates personal assets from service liabilities, thus supplying a guard versus claims.Furthermore, entrepreneurs can utilize depend hold assets, guaranteeing they continue to be secured from creditors and lawful disagreements. Territories with strong asset security legislations, such as Nevis or the Cook Islands, are typically preferred for their desirable guidelines. Executing appropriate insurance plans and branching out investments further boosts security, decreasing susceptability to market changes. In general, utilizing these techniques within an offshore framework not only promotes wealth conservation yet likewise cultivates long-lasting financial stability, enabling entrepreneurs to concentrate on development and advancement without excessive issue over asset direct exposure.

Opening Up Offshore Financial Institution Accounts

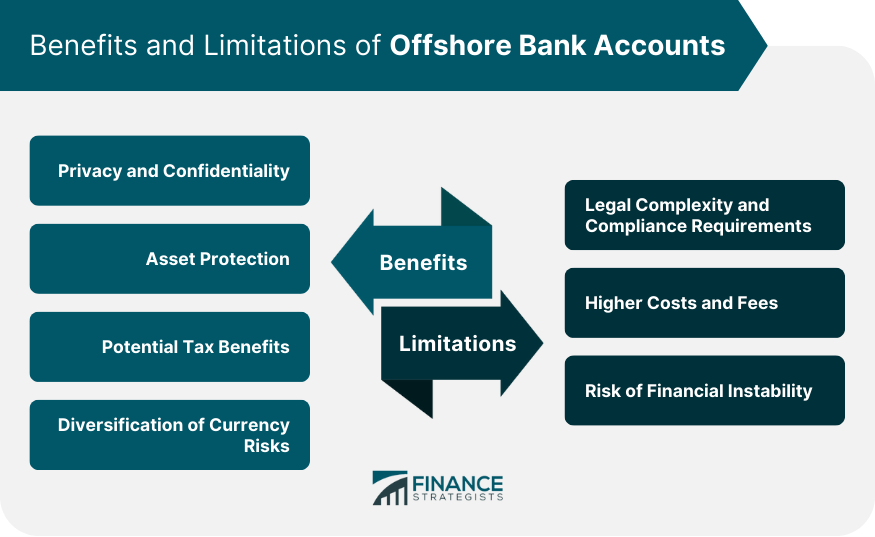

Opening up overseas bank accounts includes recognizing the different account types readily available, which can satisfy various monetary needs. Additionally, the paperwork process is necessary, as it usually calls for certain types of identification and proof of home. This summary will clarify the alternatives and needs for individuals and businesses seeking to develop offshore financial connections.Account Types Supplied

Offshore financial institution accounts can be found in numerous types, each made to satisfy different economic needs and objectives. Personal accounts are customized for people seeking personal privacy and asset defense, while corporate accounts promote service transactions and administration of business funds. Multi-currency accounts are prominent among global financiers, permitting deals throughout different currencies without too much conversion charges. Furthermore, savings accounts supply rate of interest on down payments, appealing to those aiming to grow their possessions securely. Some banks additionally supply investment accounts, supplying customers accessibility to different financial investment opportunities. Each check it out account type might include distinctive advantages and features, permitting clients to select the one that straightens best with their monetary strategies and goals. Recognizing these choices is fundamental for efficient overseas financial.Needed Paperwork Process

To effectively open up an overseas financial institution account, prospective clients have to prepare a collection of specific papers that please regulatory demands. This usually consists of a legitimate key or government-issued identification to confirm identification. Customers are also needed to supply evidence of house, such as an utility expense or bank declaration, dated within the last three months. Additionally, a thorough description of the source of funds is required to guarantee compliance with anti-money laundering guidelines. Some financial institutions might ask for a service strategy or recommendation letters, specifically for company see it here accounts. Each territory may have special demands; as a result, talking to an expert in offshore services is recommended to identify all paperwork is complete and exact, helping with a smoother account opening procedure.Conformity and Regulatory Considerations

Steering the intricacies of compliance and regulative considerations is vital for any kind of entity seeking offshore company developments. Entities have to stick to various worldwide and neighborhood legislations that regulate monetary activities, tax, and business administration. Trick policies commonly include anti-money laundering (AML) laws, recognize your client (KYC) protocols, and reporting requirements to assure transparency.Business have to stay vigilant concerning changes in regulation that may influence their operational condition. Failure to conform can result in severe charges, including penalties or the dissolution of the company. Involving with legal and financial experts that specialize in offshore laws can offer crucial assistance in guiding via these ins and click for info outs.

Furthermore, recognizing the effects of tax obligation treaties and international contracts is basic for maintaining compliance. Business need to prioritize establishing durable conformity structures to mitigate risks and assure lasting sustainability in their overseas endeavors.

Choosing the Right Offshore Jurisdiction

Exactly how does one figure out one of the most ideal offshore jurisdiction for company formation? The choice of jurisdiction is critical and involves a number of variables. One need to assess the lawful structure and guidelines regulating business in potential territories. Desirable tax obligation regimens, such as reduced or zero corporate taxes, are commonly a main consideration. Furthermore, the political stability and credibility of the jurisdiction play substantial duties in making certain the defense of possessions and compliance with international standards.Additionally, the accessibility of financial solutions and the ease of operating should not be forgotten. A territory offering durable discretion stipulations can additionally be advantageous for those seeking privacy. Ultimately, reviewing the expenses connected with firm development, maintenance, and possible legal fees is vital. By evaluating these elements, one can make an educated decision, making certain that the selected overseas jurisdiction lines up with their business objectives and functional needs.

Regularly Asked Questions

How much time Does the Offshore Business Formation Process Usually Take?

The overseas business formation procedure normally takes anywhere from a couple of days to several weeks. Offshore Company Formations. Elements influencing this timeline consist of territory, paperwork completeness, and specific service providers involved in the formation process

What Are the Initial Prices Entailed in Establishing up an Offshore Business?

The preliminary costs for setting up an offshore business can differ widely, usually including registration fees, lawful expenditures, and surcharges for solutions like checking account arrangement and compliance, frequently amounting to numerous hundred to a number of thousand dollars.Can People Kind Offshore Companies Without Expert Assistance?

Individuals can practically form overseas companies separately; nonetheless, they typically experience intricate legal and governing needs. Offshore Company Formations. Expert help is recommended to browse these obstacles effectively and guarantee conformity with appropriate legislations and policiesWhat Documents Are Needed for Offshore Business Registration?

The papers required for overseas business registration generally consist of identification evidence, a detailed company strategy, proof of address, and, in some jurisdictions, an affirmation of beneficial ownership and resolutions from supervisors.Exist Recurring Upkeep Costs for Offshore Business?

Recurring upkeep charges for offshore companies are typically called for to assure compliance with local guidelines. These charges may include annual renewal charges, registered representative solutions, and accounting, differing by territory and details business structure.

Report this wiki page